Why the Bond Market Could Be Headed for a Collapse

This is not fear-mongering; the bond market could be headed for a collapse. It’s currently under a significant amount of stress. Mark my words, a bond market collapse could cause a lot of damage to your wealth.

The bond market is worth keeping a close eye on even if you don’t own bonds.

First, you need to know what’s happening. Currently, central banks around the world are either raising rates, or talking about it.

For instance, the Federal Reserve has raised interest rates several times, and it’s expected to raise them further. The Bank of Canada and Bank of England have raised rates too. The European Central Bank (ECB), and the Bank of Japan are hinting that they would like to raise rates.

As this is happening, inflation is starting to kick in as well. All the money that was printed had to show up somewhere, right?

Inflation in the U.S. in 2017 mounted to 2.1%; this was similar to 2016 inflation figures. Mind you, inflation figures have been above two percent for two years. (Source: “CPI-All Urban Consumers (Current Series),” Bureau of Labor Statistics, last accessed January 31, 2018.)

Elsewhere in the global economy, inflation is picking up as well.

Why do inflation and interest rates matter? These two factors are bonds’ biggest enemies.

Bond Yields Spiking Higher

With this said, bond investors are spooked. Look at the yields in the bond market, and this becomes very evident.

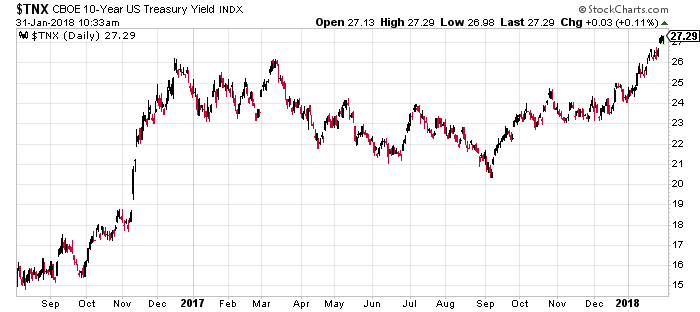

Consider the chart below of the yields on the 10-year U.S. Treasury, the most quoted bonds:

Chart courtesy of StockCharts.com

Over the last year-and-a-half, yields on the 10-year U.S. Treasury have skyrocketed over 80%. Remember that when yields are rising, it means bond prices are declining.

If you look at other bonds, their yields have spiked higher. For example, two-year U.S. Treasury yields have spiked close to 200%.

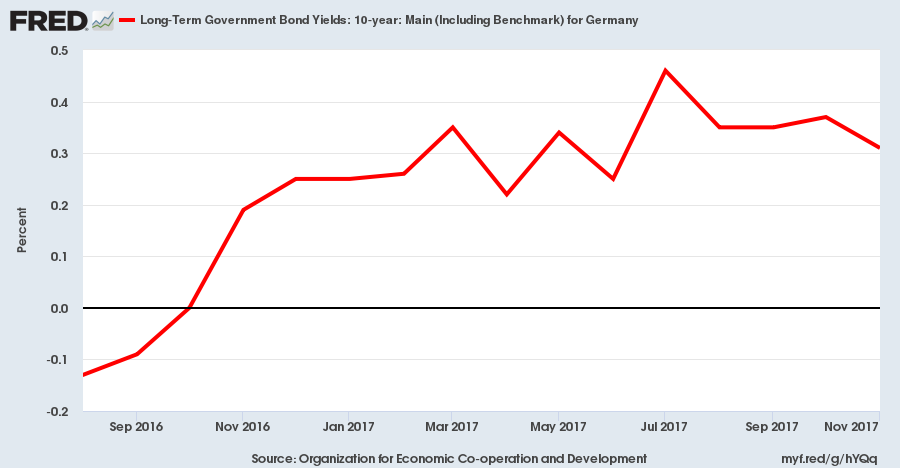

Looking at other countries’ bonds, they are suggesting that investors are getting nervous too. Look at the yields on German 10-year bonds. They briefly had a negative yield, and now those yields are spiking higher as well:

(Source: “Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for Germany,” Federal Reserve Bank of St. Louis, last accessed January 31, 2018.)

Where Do We Go From Here?

You should know that the global bond market is, hands-down, several times bigger than the stock markets. In the U.S. alone, the total outstanding bonds are worth roughly $39.0 trillion.

You have to wonder what happens if the bond market witnesses a collapse, where yields spike higher significantly and bond prices drop.

If there’s a collapse in the bond market, you could almost bet that it’s going to cause a lot of volatility across the board.

Keep in mind that bonds are held by pension funds, central banks, and commercial banks, all of which could panic and sell. They will need a place to park their money.

Don’t be shocked if panic in the bond market causes panic in stock markets as well. If you recall, we saw an incident a few days ago where bond yields spiked higher and stocks witnessed a solid drop.

Dear reader, time will tell, but I can’t stress this enough: if you are not watching the bond market, you could be making a big mistake. It’s easily one of the biggest risks to wealth right now.